I've added a small followup to this post here.

In a recent interview with NTV, while addressing the provincial budget deficit, Premier Dunderdale stated that

"16% of people in the province pay 70% of the taxes. We need to talk about that."

The premier seems to feel that most Newfoundlanders (i.e. the non-rich ones) do not pay their fair share of taxes. Perhaps she is setting the stage for a regressive tax hike or perhaps she feels that introducing the idea will make cutbacks more palatable and help her with labour negotiations. In any case, her numbers are bogus and she needs to be called out on it.

I don't know where Dunderdale got her numbers (if anyone knows, please comment), but she is pretty clearly talking about

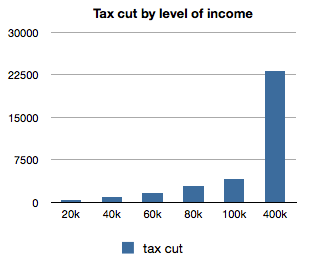

income taxes only, not taxes in general. According to the latest CRA data, the top 17% of income tax filers paid 67% of provincial income taxes in 2009. Conflating "income taxes" with "taxes" (a common trick in right-wing American politics: lucky duckies, we are the 53 percent, the Romney video, etc.) is particularly egregious in the NL context where personal income taxes make up only about 13% of government revenue.

Most people pay more in sales tax than income tax, and many spend more on gas and tobacco taxes than income tax, so focussing exclusively on income tax is deeply misleading. Furthermore, top income tax rates were cut in 2010 meaning that even the share of income taxes paid by the rich is less than Dunderdale's figure (probably closer to 60% than 70%).

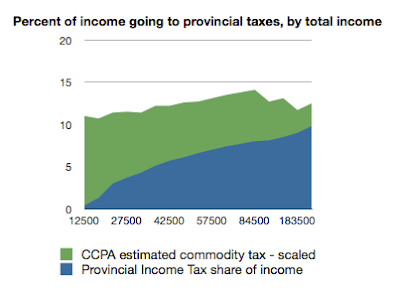

In the following chart, I've plotted my estimate of the share of income going provincial taxes as a function of total income of individuals. I've had to make a few assumptions that are explained at the end of this post.

People with total income of $10,000 or more pay 10-to-15 percent of their income on these four taxes. The rate grows with income, but only moderately. The top 17% of income tax filers receive 46% of total income and pay about 50% of provincial taxes.

But this is not the end of the story. These taxes only account for about 30% of government revenue. What about the rest?

The government receives about 17% in federal transfers and 7% from corporations. I'm going to ignore these because I'm interested in taxes on people in Newfoundland.

The biggest revenue source is offshore royalties which account for about 35% of revenue. How one understands ownership of oil revenues is crucial to deciding who is carrying the tax burden in this province. My position is that the natural resources of our province belong to the people of our province and that they belong to each of us equally. A poor Newfoundlander has as much claim to our resources as a rich Newfoundlander. If you'll grant that much, then it stands to reason that the offshore royalties belong to each of us equally, the poor as much as the rich. Thus we should treat royalties as personal income that is equally distributed and taxed at 100%.

I treat in the same way the much smaller revenues from mining royalties, NLC revenues, lotteries, driver licenses and so on. This works out to a per capita income of about $5800 a year, of which $5000 comes from oil. Treating this as personal income that is taxed at 100% results in the following chart.

From this perspective, provincial tax rates are deeply regressive. The poorest people are paying close to 40% of their income in taxes, the middle class is paying 20-30%, and the rich are paying about 15%. To use Dunderdale's standard, the richest 17% are only paying about 31% of the total tax burden.

Someone needs to ask Kathy Dunderdale "who owns the natural resources of this province?". If she replies by saying that they belong to the people, then she has no business arguing that the rich are paying more than their share.

******* Note on Calculations *******

Read more »