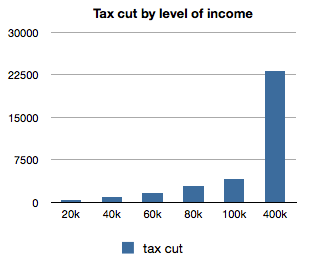

We estimate that a person working full-time at minimum wage (earning about $20k a year) received a tax cut of only $330 per year, and a person earning median full-time income (about $40k) received a tax cut of $930. Compare this to our MHAs (earning about 100k) who received an annual tax cut of $4,060 and to the wealthiest 1% (average income 400k nationally) who have received tax cuts averaging $23,000 a year.

It is outrageous that the wealth generated from our province's natural resources is being used to fund huge tax breaks for our wealthiest citizens, while providing a mere pittance to the less well-off. Consider the fact that oil royalties contribute about $4,400 per person to government coffers. This means that individuals earning more than $110,000 have gotten more than their share of oil revenues in the form of a tax cut, and that all the increased government spending on debt reduction, infrastructure investment and government services is being paid for by the rest of us.

There are much fairer ways to share the wealth. The state of Alaska distributes natural resource revenue via the Alaska Permanent Fund, which pays regular and equal dividends to all qualifying residents. Alternatively, we could distribute the wealth through the income tax code by increasing the basic personal income tax credit rather than by cutting tax rates.

We propose that before any future tax code amendment is brought to a vote, that the effect on income inequality be analyzed by the Department of Finance, that their findings be published in a plain language report that is available to the public, and that a summary be read into the public record at the House of Assembly. The people of this province deserve to be fully informed of how their money is being spent, in terms that are easily understood by the average person. Real democracy demands nothing less.

Income tax calculations

We calculate taxes assuming all income is taxable income and apply the basic personal tax credit. All numbers are corrected for inflation in 2011 dollars.

NL income tax rates in 2011:

| 0% on the first $7,989 of taxable income 7.7% on the next $23,914, + 12.5% on the next $31,903, + 13.3% on the amount over $63,807 |

NL income tax rates in 2006 (in 2011 dollars)

| 0% on the first $8,146 of taxable 10.57% on the next $24,384, + 16.16% on the next $32,530, + 18.02% on the amount over $65,060 Plus a 9% surtax on taxes over $7,731 |

No comments:

Post a Comment